Overheating and all that

Since India's overheating (or not) seems to be the hot topic nowadays, I figured I may as well add to the clutter of comments on the topic. My comments on the now-famous Economist article -

India, private equity and more ...

Since India's overheating (or not) seems to be the hot topic nowadays, I figured I may as well add to the clutter of comments on the topic. My comments on the now-famous Economist article -

I am delighted to welcome Anil Sarin, who joins as Director of Public Equities in Bessemer's Mumbai office. Here's his brief background (the full press release is here):

Anil most recently was the co-head of equities at Prudential ICICI Asset Management, India’s largest mutual fund company, where he was named a Platinum Fund Manager by The Economic Times. As Director of Public Equities for Bessemer, he will manage the firm’s listed investments and participate in due diligence activities. Anil brings to Bessemer more than a decade of public equity fund management experience. At Prudential ICICI, Anil’s four funds—the Power Fund, the Dynamic Fund, the Emerging Star Fund, and the Fusion Fund—routinely produced market-beating returns and won a number of industry awards. Among Anil’s successful investments were the Deccan Chronicle newspaper company, Subex Systems software, and Zenith Infotech, an IT services company. During Anil’s tenure, the money that he managed at Prudential ICICI grew from less than $30 million in 2004 to more than $800 million in 2006. Prior to joining Prudential ICICI, Anil was a fund manager for Birla Sun Life specializing in technology. Under his management, the Birla IT Fund won Best Technology Fund in 2001 and 2002, and the Birla Equity Fund was named Best ELSS Tax Saving Fund in 2003. Anil began his career as an equity research analyst and fund manager at SBI Funds Management. Anil holds an MBA degree from the Institute of Management and Technology in Ghaziabad, and a Bachelor’s in commerce from Delhi University. Before going to graduate school, he served in the Indian Army as an infantry officer, seeing active duty in Sri Lanka and training junior officers at the Infantry School in Mhow.In India, the distinction between listed and unlisted companies (especially the smaller ones) is quite artificial. Most Indian companies/stocks are both relatively small and illiquid, leading to many companies that are 'listed but not really public'. Several such companies still require external capital to grow, making PIPEs a significant part of the Indian private equity market. While we've already made a few PIPE investments, Anil's public equity fund management experience will significantly strengthen Bessemer's ability to look at the universe of Indian listed companies.

NRS 2006 survey results came out a few weeks back. This is a survey of over 2.84 lakh individuals that measures media exposure in India. The sheer scale of the sample makes this one of the most comprehensive and insightful studies on the Indian consumer. Here's the 'Indian media pyramid', that mirrors the Indian consumer pyramid:

I feel a mix of pain and anger at the Mumbai blasts.

Pain - seeing the inconsolable suffering of innocent victims and their friends & families. My wife was on a train in Bandra around 6pm yesterday, and it’s only a matter of chance that she is unhurt. Others were less fortunate, and our hearts go out to them.

As for the cowardly scum who perpetrated this crime – yes, you’ve hurt some of us beyond repair. However, as a city and country, we’ll quickly get back to our feet. Since moving to Mumbai 5 years back (like everyone else, to earn a living), I’ve seen the city’s amazing resilience and Mumbaikars’ willingness to help each other out in a crisis. It’s a great city that will only get stronger after such events.

As for today, we donate blood, do what we can to help, get back to work and yes, take the train home!

The May 1, 2006 issue of BusinessWorld has an insightful article on Indian consumers, written by Rama Bijapurkar based on a report published by Hansa Research. Trust me, it's worth going through the hassle of free-registration to read this article. In this study, consumer segments are defined according to what people consume/own, as opposed to how much they earn. The efficacy of this methodology is best summarized in Rama Bijapurkar's own words -

I have said ad nauseum, and beg leave to say again, that consumption data is like maternity — a certainty; while income data is like paternity — often a matter of opinion.Income-based segmentation suffers from systematic under-reporting and typically misses out the black money component. In a market like India where the majority are employed in the unorganized sector, the resulting errors can be significant. Without further ado, I reproduce 3 pictures from this article, that speak a lot more than 3000 words from yours truly.

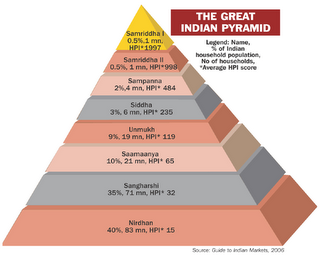

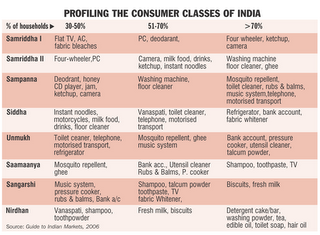

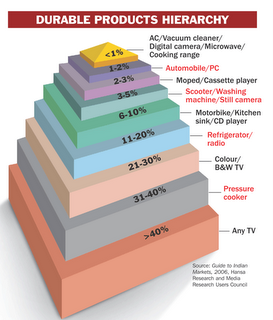

The first two pictures go together and lay out various consumer segments, classified according to assets they own and products they use. Here's the user's manual to decipher what they mean (I couldnt understand the Sanskritised segment names myself):

The first two pictures go together and lay out various consumer segments, classified according to assets they own and products they use. Here's the user's manual to decipher what they mean (I couldnt understand the Sanskritised segment names myself):

The basis is a construct called HPI (Household Potential — or affluence — Index), which calculates for each household a score based on the consumption or non-consumption of a basket of 50 FMCG and durable products. A higher score is awarded for a less penetrated one (e.g. air conditioner or ketchup) and a lower score to a widely penetrated one (e.g. colour TV or toothpaste). Households with similar HPI scores have been grouped together to create eight consumer classes. Each has been further described in terms of specifics of ownershipI find this data fascinating -

From pontificating on reservations in higher education, I am back to my more mundane day-job world to announce another India investment. Along with New Vernon Private Equity, Bessemer has invested in Motilal Oswal Financial Services, one of India's leading stockbroking firms serving both institutional and retail investors. Mr Motilal Oswal and Mr Raamdeo Agrawal founded the company in 1987. Multiple bull-and-bear markets later, Motilal Oswal is arguably the best 'Indian' stock broking house, competing effectively against India-operations/JVs of various global firms (including the bulge bracket ones). On the retail side, they have an extensive reach of over 500 branches/franchisees across India. On the institutional side, Motilal Oswal serves a wide range of global asset managers who invest in the Indian markets. As a regular reader of their equity research, I can personally vouch for its high quality! For a more unbiased opinion, in March 2006, AQ Research (a UK-based firm that analyses the accuracy of a broker’s research call) declared Motilal Oswal the best research house for Indian stocks. Beyond stock broking, Motilal Oswal offers commodity trading and wealth management services, and is setting up its investment banking operations.

In terms of the market, our thesis is that rising consumer incomes will translate into disproportionately higher allocation of these funds into equities. Right now, under 3% of India's retail assets are invested in stock markets. Cash, bank deposits, real estate and gold dominate the pie-chart on how Indians invest their wealth. As economies develop, this % rises to as high as 30-35% in the US. Further, the stock broking industry is highly fragmented and seeing a gradual consolidation. Motilal Oswal's growth has outpaced that of the industry and the company should continue to gain from this consolidation.

The main concern with the brokerage business is cyclicality. Trading volumes drop sharply during a downturn. When (notice that I havent said 'if') the Indian stockmarket enters the next bear phase, Motilal Oswal and its competitors will clearly be affected.

Then what? We wait! Ups-and-downs are a part of this game, and one of values of patient capital is to be able to support a company through a potential downmarket. The secular shift towards greater equity investment will continue and we expect growth across a cycle to be robust. Further, leading firms are better placed to weather a downturn and may even be able to accelerate industry consolidation by rolling up smaller firms that have been affected to a much larger extent.

For those who havent been to their website yet, check out the two rules on the top-left of the page!

Press coverage on the same can be found here, here and here.

I've avoided writing about political issues here, but cant resist expressing my views on the suggestion to increase caste-based reservation in higher education. Frankly, it doesnt matter whether the basis is caste or something else. Like several others, I strongly oppose the very notion of anything other than merit being the admission criteria. In the spirit of full disclosure, I fall into what's called 'general category' and made it through assorted entrance tests without any benefit from reservation (though, a generous dose of luck may have played some role)!

Here's a quote that I heard at my earlier job - to get somewhere (in life), you need to either 'know something' or 'know someone'. Thanks to 40+ years of license raj, the 'knowing someone' angle has been particularly relevant in the Indian context. Coming from a typical middle-class family, the disadvantages of not 'knowing someone' become apparent fairly early. Several activities - getting school admission, driver's license, job, housing, even movie tickets - seemed a lot easier for others who 'knew someone'. Of course, one could always get to 'know someone' fairly quickly and really well by paying bribes, but a combination of ethics and affordability limited the use of this route.

A few months past my fifteenth birthday, my parents generously gifted me my first set of IIT JEE preparation material and not-so-gently suggested that I start working through the same. Then, I didnt fully realise the wisdom of their suggestion, but like any dutiful son, did as they prodded. Somewhere along the process, even I realized something very curious about this whole IIT-thing. This was the first case where 'knowing someone' didnt matter. It only mattered whether I 'know something'. At first, I couldnt even believe it. Here is one place where I didnt have any disadvantage over my schoolmates (even the ones whose dads were IAS officers, politicians, wealthy businessmen or could otherwise afford to pay capitation-fees). In retrospect, it was one of the few truly level-playing-fields I encountered. All I had to do was to use the brains I had inherited and work really hard. I still may not succeed, but at least, it wont be due to any 'extraneous' factors. This very notion of a pure 'meritocracy' was (and still is) quite liberating. Over time, a whole bunch of people (including Silicon Valley among others) figured this out, and IITs are what they are for this reason.

I realize that my words about 'meritocracy' and 'level playing fields' are meaningless to most of the Indian-poor. For them, the world is fairly 'unlevel', starting right from access to primary education. While the middle class by-and-large has reasonable and equal access to the IITs and IIMs, the same is not true of the poor. Similarly, large parts of our education system remain 'unlevel' even for the middle class (think of all the capitation-fee colleges). These are clearly difficult and critical problems that the government (and all of us) need to address.

But, let's not mix these up with what the government is trying to do right now. Instead of spending their time on areas where equal opportunities are not available to all, the government is instead trying to f*&k up one of the few level-playing-fields that actually exist. To me, this is ridiculous and retrograde.

The Indian stockmarket is going berserk. There's a Sergei-Bubka-type phenomenon of setting new records & breaking the same the very next day. While I broadly think India's going places and all that, the stockmarkets have gotten way ahead of fundamentals. Here are my top 5 signs that the Indian markets are overvalued:

1. Equity analysts are justifying valuations on the basis of FY08 and FY09 earnings multiples. Companies havent even declared FY06 results and for most Indian companies, FY07 numbers are wild-guesses at best. I've seen reports that say '25x FY08 earnings sounds reasonable' with a straight-face!

2. Every report that I read in Jan 06 showed year-end estimates for the Sensex at under 11,000. The authors of these reports dont seem overly worried that we've reached the 12-month target in 3 months.

3. Mutual fund branding has reached ludicrous levels. Tiger, Lion, Hi-Fi, Future Leaders are all names of new mutual funds. Advertising for these funds draw analogies to Birbal's wisdom and building the Taj Mahal!

4. Pre-revenue startups are hiring investment bankers to raise venture capital.

5. One out of 3 people I met at a party last week had raised an India-fund in the last 3 months.

The greater fool theory is being played out right now, as each investor hopes to find a sucker who'll buy the same shit at a higher price. What if we run out of fools? I guess that's never happened in the history of civilization!

We've just invested Rs. 100 crore ($ 23 million) in Shriram EPC Limited, a specialized engineering & construction services company in India! This is our fourth India investment, after Rico Auto, Sarovar Hotels and BA Systems. That's as good an excuse as I have for not blogging, as I've been really busy over the last 6 weeks on this front.

Shriram EPC is a part of the Shriram Group, a reputed Chennai-based conglomerate known for its financial services businesses (chit funds, truck financing, consumer lending). Shriram EPC builds small-midsize power plants with a focus on renewable energy (i.e. biomass-based plants & windmills), does industrial construction (builds parts of steel & other metal plants, constructs cooling towers) and works with municipalities on water/sewage projects. Besides the niche focus on specific areas within the infrastructure sector, Shriram EPC also has strong technology tie-ups in most of its business lines (e.g. with Hamon, world's #2 cooling tower company). We really liked Shriram EPC's management team, most of whom have over 2 decades experience in the sector. On a personal note, Shriram EPC's CEO - T Shivaraman - and I are both alumni of both Don Bosco School in Madras and of IIT Madras. (Since hardly 1-2 people make it to IITM from Don Bosco, I suspect the two of us are part of a rather small group of people with affiliations to both these institutions).

We've been tracking India's infrastructure 'catch-up' over the last year. We (and several analysts) believe that India is now on a belated but sustained push to invest in infrastructure across-the-board (power, roads, water, ports/airports, urban development). Based on how such infrastructure build-outs have happened in other parts of the world (think of USA's freeway network built in the last century & China's efforts over the last 20 years), this process spans several decades. These are still early days in India, and we expect these investments to sustain over the many years to come. I (and you) know that there will be some stops-and-starts along the way, but process is irreversible.

Shriram EPC fits well into our thesis of being a part of this infrastructure build-out. Having grown up in Chennai, I am familiar with the Shriram Group and hold them in high regard. I am personally glad that Bessemer now has an opportunity to work with the group. On a lighter note, I now have an official reason for regular visits to my family in Chennai!

While the real work begins now, I hope I'll get back to blogging more often now that the investment is completed!

Press coverage of this investment - 1, 2, 3, 4. Here's the official press-release:

Bessemer Venture Partners invests Rs.100 crores in Shriram EPC Ltd.To fuel its fast growth, Shriram EPC Ltd. (SEPC) has raised Rs.100 crores ($ 23 million) equity capital from Bessemer Venture Partners, a leading Global Venture Capital and Private Equity Firm. Shriram EPC Ltd., a member of the Chennai-based Shriram Group, is an emerging leader in Engineering Services Segment. The Company provides turnkey solutions in Power Projects, Metallurgical Projects, Cooling Towers, Water Treatment Plants and Windmills. The investment will fund SEPC’s growth plans. These include expanding existing capacity of windmills, acquiring new technologies and consolidating its leadership position in providing non-conventional energy solutions.It will also help the Company to commit larger resources to R&D and commercialisation of new technologies in the areas of Coke Oven & Coal Gasification.

Started in 2001, the company has been growing aggressively and currently sitting on the order book position in excess of Rs.600 crores ($ 140 million) with pipeline of business opportunities in excess of Rs.1,500 crores ($ 350 million). Mr.T.Shivaraman, CEO of SEPC said “This investment will help us achieve our target of Rs.1,000 crores plus ($ 230 million) turnover by 2008. Not only does this investment give us the funds, but Bessemer’s brand also adds a significant value when it comes to international technology tie-ups.”

According to Mr.Rob Chandra, General Partner at BVP, "Infrastructure build-out typically spans several decades, and India is in early stages of seeing significant investments to bring its infrastructure upto global standards. As a specialized engineering services company with a clear focus on technology, Shriram EPC is well placed to benefit from this growth. We are pleased to be associated with the Shriram Group and are impressed by Shriram EPC's strong management team and robust order pipeline across various high-potential sectors. We look forward to partnering with Shriram EPC as they continue to aggressively grow their engineering & construction business. "

Bessemer Venture Partners is the oldest venture capital and private equity firm in the United States, with investments throughout the world. With offices in Silicon Valley, Boston, New York, Shanghai, and Mumbai, the firm manages two billion dollars of venture funds, carrying on a tradition of hands-on, active investing that has continued since 1911. Its India presence represents the Firm’s first office outside North America in its 95-year history. Over 100 Bessemer companies have gone public, including American Superconductor, Ciena, Gartner Group, Ingersoll Rand, International Paper, Maxim, Parametric, Perseptive Biosystems, Staples, VeriSign, Veritas and W.R. Grace.

KPIN Capital Consulting Pvt. Ltd., Mumbai, acted as Exclusive Advisors to SEPC for the investment.

Shit, it’s been ages since I wrote. For the few that remotely care, sorry! Life’s been insanely busy over the last several weeks. I finally managed to make time to read as well, and am intrigued enough to write about the book I read.

Among my pet hates are 3 categories of books - those that tell the reader how to (1) lose weight, (2) be happy and (3) make more money. I view such books as a general attempt to swindle readers. The first category says ‘eat right, move your butt’ in various lengthy ways. On the second, if you can afford to buy a self-help book, you’re doing fairly ok to start with. Look around at the less fortunate, stop whining and be happy with what you have. The third typically goes down the ‘buy low, sell high’ route and are mostly written by people who weren’t that successful at making money anyway (or else, why’d they need to write such books for a living). Given my prejudice, when my colleague – Rob Stavis – sent across a book titled ‘The Little Book That Beats The Market’, my initial reaction was skeptical. Stavis himself ran arbitrage trading for Salomon Smith Barney, and knows a thing or two about beating the market. This book ia authored by Joel Greenblatt, whose hedge fund – Gotham Capital – has delivered over 40% annualized returns over a 20-year period! Further, the book didn’t look intimidating at all. In fact, it is a 150-page pocketbook that can be completed in one sitting.

I am really intrigued by what Greenblatt writes in this book. The central thesis is ‘buying good businesses at bargain prices is the secret to making lots of money’. Sure, that’s obvious. Greenblatt then goes on to propose a simple ‘magic formula’ to identify good businesses that are available at bargain prices. The two metrics he uses are:

1. Good business = one that generates high return on capital, as measured by EBIT/(net working capital + net fixed assets)

2. Bargain price = high earnings yield, as measured by EBIT/(market value of equity + net interest bearing debt).

EBIT stands for Earnings Before Interest & Taxes or pre-tax operating earnings. Note that both of these metrics do NOT require any estimates or projections, and are measured purely using past data (last 12-months EBIT & current balance sheet, equity values). All one needs to do is rank all listed companies on these 2 metrics, and invest in those that have a high rank on both counts.

This may sound very simplistic, but wait till you see the results. Greenblatt applied this ‘magic formula’ to a 17-year period from 1988 to 2004, and created a hypothetical portfolio of top-30 stocks that this formula throws out (the portfolio is juggled once a year, using the same formula). Such a portfolio would have generated annual returns of 30.8% over this 17-year period, compared to 12.4% for the S&P 500! Greenblatt goes on to perform various statistical tests, to show that this super-performance isn’t due to luck or some statistical aberration, and that the formula works across different scenarios. It may always be possible to find specific companies that rank poorly on these metrics, but go on to make spectacular stock returns. However, at a portfolio level (say, 20-30 stocks or more), this formula outperforms the market by a margin that’s doesn’t leave much reason for doubt.

This is the kind of book that left me scratching my head, with tons of questions (but, doesn’t the value of a firm depend on future earnings & growth?). At the same time, I cannot deny that this seems to work really well, in the face of hard data.

I’d encourage you to read the book, visit www.magicformulainvesting.com and enlighten me if you have any more insights on this matter.

I attended Digital Summit 2006, a conference on the Indian Internet sector, organized by IAMAI. Technically, the conference also covers wireless, but most of the discussions focused on Internet. Here are my observations, after discounting for the natural self-promotion that occurs at such conferences:

Let me start with my definition for ‘significant scale’. My medium-term target would be 30 million households having high quality (over 256 kbps), affordable ( under Rs. 500/month for PC-EMI + net access without download limitations), reliable internet access at home. I deliberately pick 30 million, as that is the number of households who’ll earn over Rs. 0.2 million/year in the 2010 timeframe. There is also a qualitative aspect that I’d like to emphasize. I read a quote from an average-Joe in the

There is no shortage of compelling content/applications (travel, stock-trading, jobs, shopping sites have been around), though regional language content can still be strengthened. In my view, access is the main bottleneck. Drawing lessons from two notable Indian success stories – cable TV and cellphones – here’s what I’d like to see over the next 1-2 years in the internet access space:

I am writing this during a painfully-long stopover at the Heathrow airport, on the way back from the US. It’s been a while since I blogged. Other than the real reasons – I’m lazy, didn’t feel like writing and didn’t have anything to write about anyway –my somewhat-true excuses are that I’ve been fairly busy and traveling over the last 2 weeks. I was in Las Vegas for the Consumer Electronics Show, where we had our annual Bessemer Associates offsite, and then spent a few days in our Silicon Valley office.

CES is best described as a mela. There are thousands of gadgets displayed by hundreds of companies, across audio/video, computing, wireless, home networking etc. I am told that this year’s attendance exceeded 150,000 people. As an aside, Las Vegas has 5 times the number of hotel rooms that India has! As I wandered across various booths, I couldn’t help noticing that there were no Indian companies at CES. I did see a booth named ‘Goyal Brothers & Sons’, but they turned out to be a distributor! Electronics and hardware manufacturing doesn’t seem to be our strength. I did see hundreds of Chinese companies, though.

The highlight of my Vegas trip (not counting the fact that Adult Video Awards were also held in Vegas, concurrently with CES) was playing golf for the 1st time in my life. This brings me to the main point of this post (actually, I doubt if there is one). Every person in the world falls into one of two segments – ‘pseud’ and ‘country’. Some of you know what these terms mean. For the rest, pseud loosely translates into sophisticated or pretentious, depending on how charitable or harsh you want to be. In the spirit of being MECE, everyone else falls into the ‘country’ segment! Pseud folks play golf, claim to understand poetry & philosophy, watch art films, wear designer clothes and can correctly pronounce the menu in a French restaurant. ‘Country’ people eat using their hands, aren’t really sure how to use cutlery and haven’t graduated beyond Ilaiyaraja music or Govinda movies. I am sure you disagree with one or more of these symptoms, but you get the broad idea. There is some correlation between being pseud and being rich, but IMHO, being pseud or country is really a state of mind. Either segment mostly looks down on the other, though there is the occasional envy as well.

I am basically a ‘country’ guy (hey, I went to IITM) and golf seemed like the ultimate pseud pastime. When the other associates suggested a day of golf, I was quite apprehensive. I was reassured that there were other novices in the group, and that the day would start off with a golf lesson. Lesson or not, I turned out to be as competent and elegant on the golf course as Sourav-da on a bouncy wicket. Conceptually, this game appears simple enough (hit ball in general direction of hole). Much like in running companies, execution is a lot harder than it seems. At the end of 4 hours, I hadn’t completed a single hole and had a sore back. On the positive side, there was good company and cold beer at the end of it all. I am told that this stuff is good for networking, and networking is good for career and all that. Me thinks I should do more deals in South India, where I can bond over curd rice and filter coffee, and not bother going down the pseud path.

Like all bloggers, its only a matter of time before I write about the MSM! In this case, I'd like to complement the MSM. Personally, I think the two recent sting operations are fantastic. First, the expose on questions-for-cash in parliament. The second one highlighted corruption in the local area development funds allocated to each member of parliament. Such operations not only help apprehend corrupt individuals, but make others think twice before going down this path.

I am a firm believer in the power of a free market. I see this as an indirect effect of free-market-competition in reducing corruption. Liberalize media. Lots of competition. Each channel is forced to innovate. Adopts technology (spycams) and new ideas (sting ops). Gains viewership and ad revenues. Laughs all the way to the stock market. I havent done the math, but would guess that sting ops yield better returns than buying expensive cricket or movie rights. Nothing like making money, with reduced corruption as a side-effect.

Notice that I havent mentioned anything on morals, good-evil, values, ethics and the like. Like everyone else, I cherish all of these, but realize that on their own, these have done zilch in reducing corruption on a large scale. My problem with corruption as much economic as it is moral. Corruption ranks very high on my list of factors hindering India's development. I see this as a tax, that's literally charged as a % of GDP by various government functionaries, eating into funds allocated for infrastructure, rural development, health, education, you-name-it. Even an incremental reduction in this tax will directly add several percentage points to GDP.

I realize that markets are imperfect. We'll always have market failures and distortions. In my own home state, the leading TV channels are owned by political parties. Similar to pathogens, politicians are quick to develop immunity and workarounds against any medicine. They'll get smarter at outwitting spycams. Thanks to the free market, the media will match politicians stride-for-stride, in coming up with better ways of generating scoops. Bribe-takers will have to be more alert than before. The heightened threat of exposure will make people hesitate. I am not naive enough to think that a few spycams will eliminate bribes. However, on the margin, we'll see a decline in corruption. The additional 5% freed up for its intended purpose can make a significant difference.

There are the usual arguments on ethics and privacy, against such sting operations. While these are valid in their own right, I couldnt care less if the outcome benefits efficiency and development!

All of us go through those "Why do I even bother" moments. Here's one of mine: It's 9pm. I've just spent the last 3 hours poring over gory legal documents (I didnt know this was part of the job description, when I joined venture capital). Just when I thought I'd seen it all, I run into the following work of art:

Any other acts whatsoever beyond the reasonable control of the Party affected, then the Party so affected shall upon giving prior written notice to the other be excused from such performance to the extent that such cause prevents, restricts or interferes with it PROVIDED THAT it shall use its best to avoid or remove such cause of non performance and shall continue performance hereunder with the utmost despatch whenever such causes are removed; then upon such prevention, restriction or interference as aforesaid arising, the Investors and the Company shall meet forthwith to discuss what modifications (if any) may be required to the terms of this Agreement in order to arrive at an equitable solution.I read it once. I read it twice. I read it thrice to confirm that this is actually a single sentence. I swear loudly in Tamil (somehow this activity is a lot more fulfilling when done in the vernacular). O@$#$a o@#$a. Finally understand (not the sentence but) why there are so many lawyer jokes.

We've made our first investment in the Indian travel sector!!! Bessemer has invested (along with New Vernon Private Equity) Rs. 38 crore ($ 8.5 million) in Sarovar Hotels, to build out a chain of budget hotels in India, under the Hometel brand.

The simplest way to express Bessemer's investment philosophy is "We back strong entrepreneurs addressing large markets". Our investment in Sarovar fits squarely with this philosophy.

Sarovar is India's largest hotel chain in the mid-market segment, managing 35 properties in the 3/4-star category. Sarovar's MD - Anil Madhok - has 40 years of hotel management experience, including the last decade as an entrepreneur, having founded Sarovar in 1994. Anil and his team have the unique combination of extensive hotel management experience in India, expertise in the mid-market (as opposed to premium) segment and a successful entreprenurial track-record with Sarovar. They have scaled up Sarovar into India's leading hotel management company in just over a decade.

You've probably read at least one article on India's hotel room shortage (India has fewer hotel rooms than Manhattan)! If you've travelled in India recently, feel free to share your personal anecdote on paying an arm and two legs for a hotel room. India's hotel room shortage is most acute in the budget hotel segment. If you are looking for a hotel room under Rs. 3000/night ($65), you have very few options where you know what you are getting into. Hotels in this price range are highly variable in quality, cleanliness, safety and service. Except for one Tata IndiOne hotel in Bangalore, there are no brands or hotel chains in this segment. As I've written in an earlier post, the largest opportunities in India are for those offering good quality products/services at prices that are affordable to the mass market. Hometel aims to do precisely this.

So, what does Hometel offer? All the basics - central a/c, hot/cold water, TV, direct-dial phone, mini-fridge, tea/coffee maker, writing desk, electronic locks, WiFi - at an affordable price of Rs. 1500-2500 per night ($35-55). What is doesnt provide are the frills - multiple restaurants, large lobbies with chandeliers, swimming pool.

Similar to low-cost airlines, budget hotels need to be designed and operated very differently from their full-service counterparts. Budget hotels are about consistently good service, value-for-money pricing, low capex per room and reduced opex (fewer staff, no-frills). The first two factors ensure high utilization (revenues) and the next two drive profitability. This is clearly an execution game, where Sarovar's expertise is critical.

We believe that Sarovar's team can execute to plan and become India's leading hotel chain in this segment. Sarovar plans to cover both metros and (more importantly) smaller cities where finding good accommodation is even harder. The first Hometel will open in Bangalore in January 2006. Pune, Mumbai, Jaipur and Hyderabad are in the pipeline. 50 Hometels in 5 years is the target. Personally, I think the opportunity is large enough for a lot more!

Having written two original posts last weekend, I'll take the easy way out and use borrowed content. I happened to read this interview with Warren Buffet earlier this week. Blunt, simple, witty and wise with his words and thoughts. Here's Warren Buffet (the emphasis is mine) on: Career advice

If you want to make a lot of money go to Wall Street. More importantly though, do what you would do for free, having passion for what you do is the most important thing. … A few months ago I was talking to another MBA student, a very talented man, about 30 years old from a great school with a great resume. I asked him what he wanted to do for his career, and he replied that he wanted to go into a particular field, but thought he should work for McKinsey for a few years first to add to his resume. To me that's like saving sex for your old age. It makes no sense.Investing

When making investments, pretend in life you have a punch-card with only 20 boxes, and every time you make an investment you punch a slot. It will discipline you to only make investments you have extreme confidence in. Big money is made by obvious things. If using a discount rate of 8% vs. 10% is going to make or break an investment idea, it's probably not a good idea.

When Berkshire acquired a 90% stake in NFM in the 80's, Ms. B and I shook hands and signed a two-page agreement. There was no audit of the books, no due diligence, I trusted her integrity. When Wal-Mart sold me one of their operating units, their CFO came to my office, I gave him a price, he called Bentonville [Arkansas - Wal-Mart headquarters], and that day the deal was done. I know how Wal-Mart conducts business [very well], and when we took over the division, it was exactly how they described it. So integrity is a requirement. One of Berkshire's businesses is FlightSafety, the founder is dedicated to preventing deaths, he's not motivated by the next quarter's numbers.His legacy

I think an example is the best thing you can leave behind. Obviously, you want to leave the right example. I mean, Wilt Chamberlain's tombstone may say, "At last, I sleep alone," and that's probably not the example you want to leave. If what I've done with Berkshire Hathaway - running a unique and independent company in true pursuit of shareholder value - persists and people learn from it to improve the way they invest and run their companies, that would be a fine legacy to leave.His aversion for investing in technology companies

Technology is clearly a boost to business productivity and a driver of better consumer products and the like, so as an individual I have a high appreciation for the power of technology. I have avoided technology sectors as an investor because in general I don't have a solid grasp of what differentiates many technology companies. I don't know how to spot durable competitive advantage in technology. To get rich, you find businesses with durable competitive advantage and you don't overpay for them. Technology is based on change; and change is really the enemy of the investor. Change is more rapid and unpredictable in technology relative to the broader economy. To me, all technology sectors look like 7-foot hurdles.He has the honesty to say 'I dont know', in a topic (investing) where he could have gotten away saying any damn thing. Reminds the rest of us of how much we pretend. [Here's the link to the original article. Sorry for not providing this earlier. In reply to one of the comments, these are clearly Warren Buffet's comments. I have no pretense of offering such wisdom. Possibly, I have no wisdom!]

Shorts and longs are terminology used in the financial markets. Going long is synonymous with buying a stock and the expectation that the company would do well. Selling short implies the opposite – expect something to get worse. My colleague Jeremy Levine wrote about his ‘shorts’ and ‘longs’ here. Two recent articles on the Indian retail sector triggered this post on my ‘long’ and ‘short’ views on Indian retail.

Retail in India is an extremely interesting area, where companies are still experimenting to get the right mix of store formats and categories. While Bessemer still cannot invest in Indian retailers due to FDI restrictions, I follow the sector quite closely out of personal interest. Large retailers, with chains of stores following similar formats, are just beginning to make their presence felt and India’s largest retailer is still short of $500 million in revenue.

Here’s an idea that I’d go short on. From the Business India dated November 21 – December 4, 2005:

__ has kick-started the yoga wear segment with its new brand named “Urban Yoga”. What’s more, the brand has two ranges “Body” and “Soul”. In the next six months, __ plans to open at least 10 exclusive outlets across the country. In addition, it also plans to open yoga centres through which it hopes to attract more converts to yoga and, naturally, by extension to Urban Yoga. If __ has its way, Urban India will be moving towards spiritual fitness dressed in Urban Yoga.I am sure you can trace which company this is, if you want to. This is fantastic news for yoga enthusiasts who are worried that their clothing isn’t as well coordinated as their postures or want that extra performance boost to their suryanamaskars. I am aware of specialty retail and all that, but doesn’t this whole idea seem a little too niche.

Moving on, Food & grocery retail is as non-niche as it gets. This category accounts for nearly half of India’s consumer spend and is still dominated by mom-and-pop ‘kirana’ stores. I read an article that Chennai-based food retailer Subiksha will be opening over 70 stores over the next month in other South Indian cities and is looking to expand into North and West India as well (I cant seem to find the link). I am ‘long’ on Subiksha and view their format to be best suited to the Indian market for food & grocery retail. Their approach combines the local low-overhead front-end of Indian kirana shops with the efficient supply chain of a large retailer. Subiksha’s shops are no-frills (sub-500 sq ft, non-airconditioned), do not allow consumers to walk through the store to browse products (no aisles – no wasted area) and well distributed (they aim to have a store within 1 kilometer of any household – I suspect they are close to this target in many parts of Chennai). The consumer experience is similar to that in the kirana store – no browsing, option of home delivery, proximity of store to their residence allowing frequent buying in small lots. Their USP is a Walmart-style everyday-low-price (5-10% less than MRP and/or their nearest competitor), enabled by combining centralized buying and an efficient supply chain, with their simple (and inexpensive) store format.

The other retail format that is gaining prominence is a big-box type format, adopted by Big Bazaar and Giant. These are large shops with over 50,000 sq ft area that offer a wide range of goods in one location (e.g. food, grocery, utensils, furnishings, apparel, even appliances). By definition, such large stores are fewer in number, and their consumer catchment area could span a 5-10 kilometer radius. Big-box stores also offer low prices, similar to Subiksha. Big-box stores are well suited for retailing apparel and durables, which tend to be more infrequent, larger ticket-size and event-driven purchases. To succeed in food retail, they would require (similar to the US) good roads, cheap fuel, high car penetration, large refrigerators and storage space. Then, consumers could drive to such stores on weekends and stock up in large lot sizes. Almost all these factors don’t hold in India. While the in-store experience is superior to Subiksha’s format, getting to the store and back imposes tangible (Rs. 50-100 per trip) and intangible (inconvenience & time) costs. Further, several of these shops are located in malls that people visit as an entertainment destination. Lugging around large bags of rice and wheat don’t gel well with this. I am told (and haven’t independently validated) that apparel accounts for over 75% of Pantaloon’s profits from their big-box stores, which would be consistent with my expectation. Having said this, I do expect the larger format to dominate categories such as apparel, consumer durables, furniture and home furnishings.

I see two challenges for Subiksha’s format. First, the consumer experience at the store isn’t great. While the average Indian would readily trade this off against savings of several hundred rupees a month on the grocery bill, they could lose upper middle class and affluent consumers who spend disproportionately more. Second, to get to $1 billion revenue, Subiksha would require well over 1000 stores! Handling this many stores (including several that may be franchised) poses an enormous control and managerial challenge. Subiksha has so far adopted a gradual expansion approach, taking care to ensure quality and consistency across its outlets. Hopefully, they’ve now figured out how to manage this complexity, as they expand aggressively outside their home state.

SMS has completely transformed marketing as known to civilized man (this does not imply, by any chance, that marketing is civilized!). Every other ad hoarding between Nariman Point and Bandra demanded a follow-up sms action from the reader. They all said “SMS __ to ___” (and presumably, one’s wildest fantasies would be fulfilled by the concerned service provider). Apart from Elbonian mail-order brides (no, that is not my wildest fantasy), you could order pretty much anything else by SMS-ing a few letters to the appropriate shortcode.

This SMS-craze falls into two segments. The first lot includes companies (mostly in financial services) hoping that the reader is stupid (or lonely) enough to open up their cellphone to a barrage of sales calls. The second comprises a new breed of TV programs, where viewers decide the fate of bright-eyed men and women, who attempt to sing and dance their way to fame.

In the first category, the shortcode-Oscar went to HSBC for actually having 3 different shortcodes (possibly more – I found 3 in a mere 20 km stretch). You could sms PVA to 6161, HSBC to 8558 and Invest to 7333, to reach the hallowed bank. If you think I am making this up, go ahead and try out all three (thereby proving that you need to get a life). I suspect the same call center agent would call you thrice. Wait till their CEO figures out what his three SBUs have been up to. Other banks are not far behind, including Kotak Bank who also use 6161 (sms KM instead of PVA). So were insurers (ING to 8558, Life to 7827, BSLI to 7333). The most interesting one was a new Hindi movie – Neal n’ Nikki – asking me to sms NN to 3366. I haven’t tried it yet, but expect a steamy MMS clip from the movie, in return. Of course, you could sms any random text to the big daddy of all shortcodes – 8888 – and get something in return.

Indian television (as known to civilized man, again) has been hijacked by a new breed of reality shows where contestants sing or dance or both, undergo public humiliation at the hands of the judges, become India’s sweethearts and make shitloads of money. Some bright marketer (fill in your own witty comment here) had a lightbulb-moment and decided to get viewers to vote through SMS. We didn’t stand a chance after that. We laughed and wept as our favorite contestants swayed and hummed, and used up our hard-earned chota-recharges egging on gawky kids with colored hair. Last night, I watched one of these programs, where pairs of TV stars (presumably, married to each other) danced till all-but-one get eliminated. One lady participant tearfully told the whole nation that the greatest thing her hubby had ever achieved in life was to complete his dance performance, despite feeling somewhat under the weather. The hubby looked suitably moved due to the emotion of the moment, but would hopefully realize exactly what his wife thought of his other achievements in life. After some calm reflection, I suspect that he’ll be looking up the shortcode for Elbonian mail-order brides.

This is only the beginning. I am awaiting the speciality magazine for shortcode-afficionados (suggestions welcome for what this mag would be called). The mag would include a weekly shortcode popularity ranking, thumb-exercises to stay sms-fit (accompanied by photos of sixpack thumbs), free software to change your sms font to Helvetica etc. That would be followed by specialized brand consultants who would help companies identify the shortcode that best reflects their brand positioning (after which, the aforementioned bank would ditch 6161, 8558, 7333 in favor of 4722). As a logical extension of TV show voting, Bihar elections would be done on SMS (sms Laloo or Nitish to 24427). Naturally, the elections would not get completed, as multiple sets of goons ‘capture’ sms gateways of mobile operators and furiously stuff stamped ballots into hapless servers.

Remember 100s of monkeys clattering away on typewriters forever, with a rather small probability of producing Shakespeare’s works. Give the same set of monkeys a mobile phone each. They are still unlikely to write prose, but I’ll bet that they’ll emerge with health insurance, bank accounts, credit cards, free movie tickets and a mail-order bride! Better still, they’d have dashed the hopes of several tearful TV hopefuls in the process through their random voting.

PS. Just as I finished typing this and was getting onto the internet using my mobile data-card, I received the following sms – “Subscribe 4 Daily dose of Fun: Sms SUB JOK to 8282 to get your daily dose of Fun two times a day for 30 days @ Rs 30”.

QED

Pratham is an Indian NGO that has done some commendable work in this area. They are working on the Annual Status of Education Report (ASER) that aims to measure progress against the government's goal of universalizing primary education by 2010. Please check out Pratham's website on how you (and I) can help.

Annual Status of Education Report or ASER – is a process by which citizens (especially urban professionals) can measure and keep track of how their money is being spent to impact primary education in India. It will go on till 2010 – the year by when government has promised to unilversalize quality primary education in India. We have missed earlier goals to universalize primary education for all children – but this time its achievable !! Pratham is launching and facilitating ASER to keep track of the progress in primary education - across every state in India to cover more than 80% of all districts. We are doing this along with more than 200 grassroot organizations across India to create a citizens initiative to measure and monitor work on primary education. Government of India has promised universalization of quality primary education in India by 2010 – something that we believe is quite doable. Towards this end, over and above other taxes – 2% education cess has also been levied by government to finance this aspiration. Large progress has been made – especially with regards to enrollment of children in schools and access to school – even in the most under-developed parts of rural India. But the drop out rate continues to be very high – more than 70% children are not completing schools. Primary reason for this appears to be that learning in schools is dismal (with more than 50% children in the primary schools not being able to read, write or do basic arithmetic). Across the country, in the school educational domain, there is a need for the following: 1. To measure and track progress 2. To motivate the entire government machinery towards outcome focus and not just allocating more funds. 3. There is a need to talk about what children are learning in schools and not just how many are enrolled. We need to understand what these numbers mean. 4. There is a need to talk about factors which influence a child’s learning viz., teacher attendance, student teacher ratio, teaching learning material, teacher training, basic infrastructure, toilets, drinking water, working of village education committees etc. 5. For urban India and professionals there is a need to go beyond paying education cess and taxes – there is a need to know numbers and need to ask questions to government/s at various levels. Against this backdrop, ASER has been launched as citizens initiative to track and measure progress. The final report will be presented to the highest level of government (the report will be presented before January 26 – efforts are on to invite the Prime Minister to accept the report. Planning Commission and Ministry of HRD have agreed to accept the report – which will be presented by 600 representatives from 600 districts who will share their findings across the country). We will also go back to the district collectors, MPs, MLAs, zilla parishads, panchayats asking them about the progress in their districts and how they compare with other districts and asking them to give us plans on how they want to move forward and how they want to spend the allocated budgets (all the communication will happen before the budget in February 2006.). We will provoke gram sabhas and panchayats to discuss the state of affairs in their district and how that compares with other districts. We believe that measuring, tracking and asking questions creates its own motivation (whats gets measured.. tends to get done).

Trust The Hindu to write an excellent article on how (poorly) Indian farmers fare, based on the latest NSSO data. The article also highlights growing inequities, as liberalization has helped the rich get a lot richer.

The collective net worth of 311 Indian billionaires is now Rs.3.64 trillion. This is up 71 per cent from last year, when it was a paltry Rs.2.13 trillion. The tribe has also grown. It now includes 133 new entrants who just months ago were merely millionaires.So, Peter's doing quite well. How about Paul?

The average monthly per capita expenditure (MPCE) of farm households across India was Rs.503 in 2003. That is just about Rs.75 above the rural poverty line. And it is an average across regions and classes and income groups. So even this dismal figure hides huge inequities.Its obvious he's not doing well at all. Here's what I found even more alarming -

The data from the NSSO survey on farm spending once again points to the link between poverty and family size. The average household size for farmers was 5.5 at the all-India level. But in those with an MPCE equal to or less than Rs.225, the number goes up to 6.9. On the other hand, households with an MPCE of more than Rs.950 were much smaller. Their average size was 4.1. Broadly, the better off the household, the fewer its members. In the NSSO survey, Bihar and Uttar Pradesh logged the highest average household size of 6.1. The poor tend to have larger families. That is their insurance against higher mortality. Particularly against infant mortality. The logic of "more hands to work" cannot be wished away.I dont recommend robbing Peter to pay Paul. It's clear Paul needs help, though. I dont have any answers, and like most of us, havent done anything about it. For me, writing about the real India keeps me honest and reminds me that there's more to India than South Bombay. But I should get off my butt and actually do something about it.

My colleague David Cowan writes on how to construct a business plan. He distinguishes between the more elaborate version prepared as an internal operating document and a more concise version that's better-suited for getting through to a VC with a limited attention span! I've been guilty (along with my former colleagues) of consistently violating this principle, in my earlier role at McKinsey. We regularly prepared dense slides with loads of data, that were ideally suited to leave behind as a document of record. However, the same slides were disastrous to present in a progress review and communicate key messages to senior client managers.

Help me out here, as I cant figure out the following. Indian households are supposed to have a very small percentage of their financial savings in the stockmarket. RBI data indicates that under 2% of household financial assets are invested in equity & mutual funds. This works out to ~$2 billion invested in stocks.

Here is where it gets confusing. If you look at the shareholding of listed Indian companies, published data shows that over 12% of equity in the 30 BSE-Sensex stocks are held by "Indian Public". BSE Sensex companies have a combined market capitalization of $250 billion, implying that Indian public have $30 billion invested in these stocks. Sensex stocks account for only 50% of India's total market cap, implying that public investment in all Indian equities could be over $ 50 billion.

$ 2 billion and $ 50 billion way off. I've thought of various explanations, including 'black money' not being included in RBI data. Am I missing something here?

I think I figured this out. Despite being called "financial assets", RBI data appears to be a 'flow' figure and not a 'stock' figure. They start from GDP, separate out savings, then household savings, finally financial savings (called financial assets) - all of which are flows. And I compared this to the stock of household equity investments. HOW CAN YOU GET THIS WRONG - as Tam moms admonish their kids when they dont score centum in Maths (to be pronounced Max, for full effect). Anyway, if I add up these flows over many years, it comes to $25 billion. Factoring in stock appreciation and black money, 25 can be reconciled with 50. Amen.

Chryscapital talks about investing in India in this interview. They are among the first India-dedicated funds, and have had successful investments in the likes of IVRCL, Suzlon and Spectramind.

I am back in Mumbai after a delightful vacation in Mauritius. This Sunday evening is more depressing than usual, as I need to return to work after a 2-week break. While Mauritius invokes beautiful images of sea, sand and coral reefs, I’d like to write about man-made economics rather than natural scenery.

Based on what I saw and heard (from the locals), Mauritius has excellent infrastructure (notably roads), free school education and healthcare for all and low levels of poverty, crime and unemployment. Overall, the impression was one of a prosperous country, with a fairly content populace. I realize that as a tourist, one’s views on a new country are fairly skewed. Further, there is the usual trap of drawing macro conclusions based on micro data. So, I did a quick check on some development indicators, to make sure I wasn’t way off. See for yourself – per capita GDP of $4600, life expectancy of 72.5 years, 85% adult literacy, tele-density of 55%, 100% primary school enrolment among the relevant age-group. Not bad at all.

I am no economist (nor an expert on Mauritius policies based on one short jaunt), but cant help drawing two clear lessons for India – on the role of the government and need for broad-based job creation. First, the Mauritius government’s primary focus has been on education, health and infrastructure. Second, the nature of growth has created jobs for a broad section of the population. The three main drivers of growth – sugar, textiles and tourism – not only cover agriculture (and agro-processing), manufacturing and services, but also create ample employment opportunities for the average high-school or college graduate. By ensuring near-universal education, the government made sure that people could realistically access these job opportunities.

The idea is not to draw simplistic parallels between a nation with 1.2 million people and another with (almost) 1.2 billion people. I am encouraged by the secular growth that India is seeing, across sectors such as auto components, textiles, retail, travel and construction. While IT and ITES would rightfully create jobs for the young urban middle-class with access to English-medium college education, these other sectors are badly needed to do the same for far larger numbers of less privileged people. The challenge remains that large segments of the population are simply not equipped to benefit from these opportunities. If there are 3 areas I’d like the government to spend time & money on, these would be education, health and infrastructure. In all other areas, the government simply has to set the basic (and hopefully fair) rules of the game, and then get out of the way.

Better-half and I are off to Mauritius for a week. I intend to unplug myself from the Matrix during the holiday. I just read a very timely post on information-overload-leading-to-attention-deficit. One of those simple, yet profound, writings that leave you feeling "Hey, I can relate to that". On that note, I am off for a bit. Yensoi!

As reinforced by the recent Knowledge@Wharton article on Warburg Pincus, most private equity investors in India have focused on later-stage investments in mature industries. Over 80% of the $3-odd billion invested in India over the last 3 years are in late-stage companies. 90% of investments have been in fairly mature industries, such as construction, financial services, hotels, manufacturing, pharma, healthcare, IT/BPO and energy.

At first glance, this seems quite simple and low-risk. We know there is strong demand. The products and services are standard. There is no technology risk or long product development cycle. All that is needed is for the company to execute to plan. That’s where is gets complicated. Execution isn’t as simple as it looks on paper (or powerpoint). In fact, the only thing that differentiates between companies in India is strong execution.

Let’s take the Bharti example. At the time Warburg invested, Bharti was one of a dozen emerging telcos, that each had a circle or two. Without the benefit of hindsight, all these companies looked more or less alike. All of them had access to the same network equipment, billing software, vendors, consultants, you-name-it. They all hired from the same pool of ex-FMCG managers to handle sales, distribution and marketing. While not all of them raised $ 600 million, access to capital wasn’t an issue either as everyone was affiliated to one business group or another. Today, Bharti’s a clear market leader, while several of the others don’t even exist anymore. Bharti has done the same things all telcos did – roll-out network, get the best price/service from vendors, market services, take care of bad debts, handle customer complaints etc. Only, they’ve done each of these just a little bit better and more consistently. It’s been plain, old-fashioned execution and managerial ability. The same story repeats itself as you look at companies such as HDFC Bank, Infosys or Bharat Forge.

As an investor in India, the single most important parameter to assess is the company’s execution ability. This ties in directly to the emphasis on later stage investments, as the only way to ascertain this is to actually see it in action. The main question is how long must one wait to figure out if this is a company that can execute its way to becoming a market leader?

To answer this question, let me take a specific sector – retail – as an illustration. I break up any retailer’s evolution into two phases – a trial & error phase, followed by an expansion phase. The first phase is where one figures out the right business model specific to the Indian context. This is an iterative process that can take several years. FoodWorld was the first organized retailer in India, starting in my hometown – Madras. They toiled many years with the supermarket format, before finally figuring out that this format doesn’t work and have now shifted focus to a big-box hypermarket format. The coffee chain Barista has gone through three owners and as many CEOs, in trying to figure out its positioning and pricing. Many others are grappling with choices to be made on store formats, size, own-vs-franchise etc. Once the right model is established, it’s a question of scaling up by rolling out a proven model across cities, regions and more stores. The most optimal approach is to stay small and preferably stick to one city/region in the first phase. This limits the amount of capital being expended on the ‘error’ part of trial & error. Besides getting the model right, this phase also demonstrates the ability of the core team to pull this off.

For an investor, the best risk-reward is to invest after the first phase, in a proven business model and team that can then expand significantly with access to capital. In predominantly execution-driven businesses (as opposed to those based on IP or innovation), I’d rather not invest early. This execution thing is way harder than it looks!

Here’s some food for thought. Warburg made about 6 times their investment in Bharti over approximately six years. If you or I had bought Bharti stock in 2002, we’d have made over 10 times our money in 3 years. Better late than early?

If all Bangalorians are like Honey, I pity Americans about to graduate college. They're up against a hungry, polite, Excel-proficient Indian army. Put it this way: Honey ends her emails with "Right time for right action, starts now!" Your average American assistant believes the "right time for right action" starts after a Starbucks venti latte and a discussion of last night's Amazing Race 8. - Smartmoney.com: Esquire Magazine: My Outsourced Life

My first post from Flock. It been all of two hours, and Flock rocks already!

I visited a BPO set-up in Hyderabad earlier this week, and it felt scarily close to what AJ Jacobs writes in My Outsourced Life. I too met with a set of hungry, polite, computer-savvy and extremely competent people who had honed mundane tech-support activities into a fine art. Including an in-house software tool that allows clients to monitor any of their agents' calls real-time over the internet and tag live feedback to the call-transcript. This feedback is in-turn used in training and performance improvement. At one level I felt sorry for agents who had to live with every minute of their work being monitored by big-brother. That apart, I left feeling that the world would never be the same again, after the take-over by these hordes of young, motivated, tech-enabled agents striving to achieve customer service nirvana.

In my first year at IIT Madras, I learnt the difference between accuracy and precision. Accuracy is how close a measured/estimated value is to the true or actual value (assuming that one exists). Precision reflects the repeatability or consistency of measured values across different experimental set-ups and observers. Nowadays, I am reminded of these whenever I get into discussion (debate, really) on valuation.

In early-stage investing, valuation is simpler. There is no question of being either accurate or precise, since valuation has little to do with the company’s worth at that point of time. Valuation is a derived number from how much capital the company needs and the % of the company the VCs would like to own given the high-risk nature of the investment. Except for a vague sense that the market being addressed is adequately large, there is no pretense of knowing future revenues or profitability. Almost all early stage investments are through preferred instruments that are more like a loan with an option than straight equity and traditional valuation techniques are irrelevant. Brad Feld and Fred Wilson’s posts on this topic are quite insightful.

At the other extreme, valuation of large publicly-listed companies is simple too! Not so much in an absolute sense, but relative to smaller, less-predictable companies. Besides the traded stock price, these companies have dozens of equity analysts figuring out what the stock is worth and which way it will move. The true value of these stocks is as much a function of supply-demand and investor preferences, as they are of cash flows and discount rates. So, accuracy is questionable, but the level of precision is far higher. Analyst estimates and the actual stock price typically fall within a reasonable band. Most prospective investors are price-takers and the only decision to be made is whether to buy or avoid (alternately, sell or hold).

It is hardest to agree on a valuation in those companies that are somewhere between the above two extremes. In India, most investment opportunities that we see are in companies that are somewhere between $5 million and $100-odd million in size. These are often privately-held and almost always project rapid growth (that’s why they need the funds in the first place). The valuation dance gets messy, as these are neither here nor there. Given the small size and relatively early stage in their lifecycle, their future performance is subject to a high level of variability. At the same time, they are not starting from zero, and offer some basis (or at least, pretense) to link valuation to past or future financials.

I believe that the agreed valuation has little to do with the projected financials. It is a lot more about the softer factors – supply-demand for deals, relationships, competitive dynamics, bull or bear nature of the investing environment. The actual projections and valuation techniques tend to be more distracting than helpful. Traditional approaches that are used in valuing larger companies are mostly irrelevant:

The above techniques and numbers are ok for the both sides to separately figure out what they are willing to pay/accept. Arguing over input-metrics - growth rates, profitability, multiples – is futile. Simply ‘agree to disagree’ and move onto price. If the gap is over 30%, shake hands and get on with your lives (by the way, walking away can call any bluffs that were there in the first place). If the gap is under 30%, keep going. Time and sheer attrition will narrow the gap! Or, someone else will offer a higher price and its back to ‘take it or leave it’.

My philosophy in such discussions is simple. As an investor, I am entering a 5-year partnership with a great team going after a large market. Both sides are seriously clueless on where the company will be after 5 years. It is more important for all parties to feel positive and motivated about getting into this partnership than it is for any one party to get the best bargain. Obviously, both sides are unlikely to be wildly happy at the end of the valuation discussion. The ideal outcome is one where both sides come away thinking “I’d have been really pleased if the price was 10% lower/higher, but I am ok with this deal. More importantly, I liked the way these guys handled this.”