Insight on Indian consumers

The May 1, 2006 issue of BusinessWorld has an insightful article on Indian consumers, written by Rama Bijapurkar based on a report published by Hansa Research. Trust me, it's worth going through the hassle of free-registration to read this article. In this study, consumer segments are defined according to what people consume/own, as opposed to how much they earn. The efficacy of this methodology is best summarized in Rama Bijapurkar's own words -

I have said ad nauseum, and beg leave to say again, that consumption data is like maternity — a certainty; while income data is like paternity — often a matter of opinion.Income-based segmentation suffers from systematic under-reporting and typically misses out the black money component. In a market like India where the majority are employed in the unorganized sector, the resulting errors can be significant. Without further ado, I reproduce 3 pictures from this article, that speak a lot more than 3000 words from yours truly.

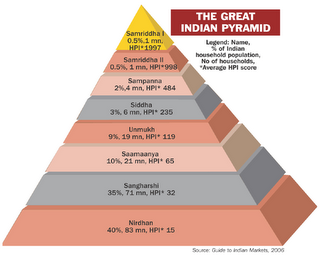

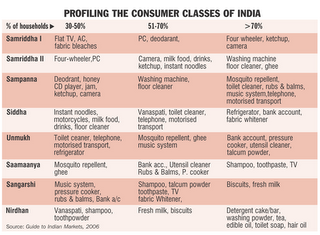

The first two pictures go together and lay out various consumer segments, classified according to assets they own and products they use. Here's the user's manual to decipher what they mean (I couldnt understand the Sanskritised segment names myself):

The first two pictures go together and lay out various consumer segments, classified according to assets they own and products they use. Here's the user's manual to decipher what they mean (I couldnt understand the Sanskritised segment names myself):

The basis is a construct called HPI (Household Potential — or affluence — Index), which calculates for each household a score based on the consumption or non-consumption of a basket of 50 FMCG and durable products. A higher score is awarded for a less penetrated one (e.g. air conditioner or ketchup) and a lower score to a widely penetrated one (e.g. colour TV or toothpaste). Households with similar HPI scores have been grouped together to create eight consumer classes. Each has been further described in terms of specifics of ownershipI find this data fascinating -

- If you are reading this on a home PC, you probably belong to the top 1% of Indian households (2 million out of 200 million)

- 18-20 million households in India have 'motorized transport' - wonder if this defines the Indian middle-class?

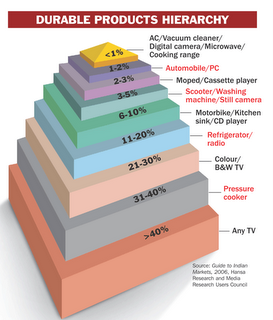

- You can make out the pecking-order of consumer durables - ACs & flat TVs at the very top, followed by 4-wheelers/PCs, washing machines, 2-wheelers/phones/refrigerators

- The data is unclear on the distinction between mobile phones and fixed line phones. However, if you juxtapose the current mobile phone base of 90 million against the pyramid, the scale achieved in a mere 5 years is staggering (Remember that the pyramid shows # of households - each household has ~5 people). I would guess that the top 3 segments account for the bulk of the postpaid consumers (20-25% of total) and have more than one cellphone per household. After you deduct these, you still need to account for over 60 million prepaid connections. This means that cellphones have actually penetrated the 'Sangharshi' segment (2nd from bottom)! To put this in perspective, half of this segment does NOT use toothpaste (before the ignorant cast aspersions on their personal hygiene, they do use tooth powder)! Kudos to our cellphone operators.